tax benefit rule definition and examples

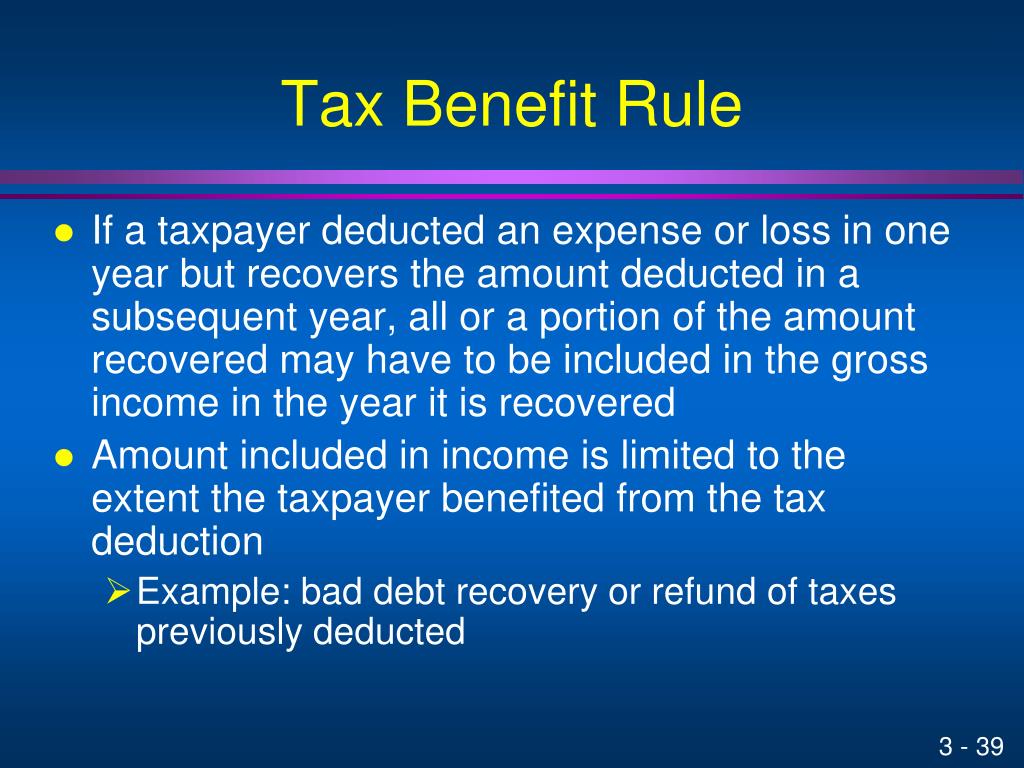

A tax provision that says. The tax benefit rule requires Company XYZ to report the 100000 as income on its 2010 tax return and pay taxes on it.

Investment Expenses What S Tax Deductible Charles Schwab

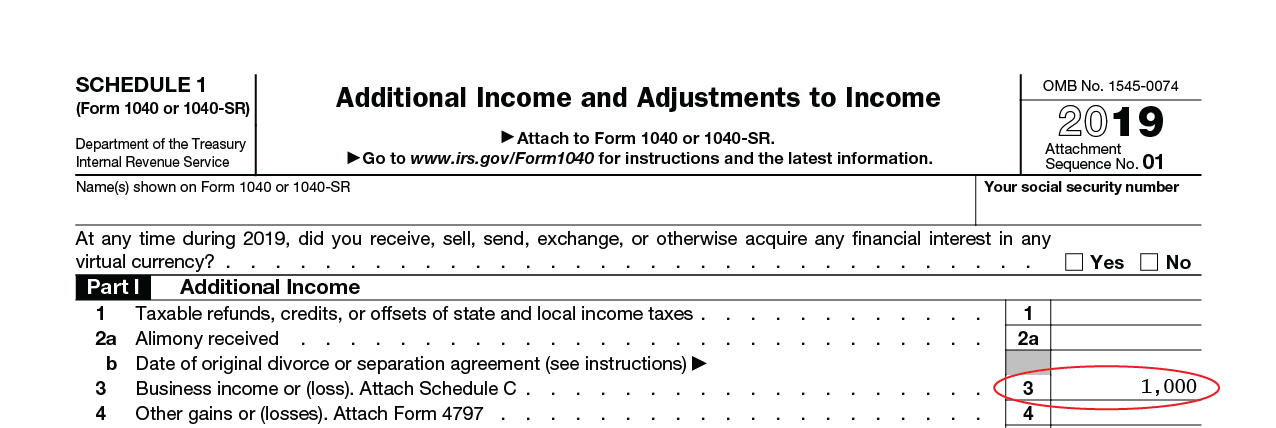

When their 2018 state income tax return was prepared the couple received a.

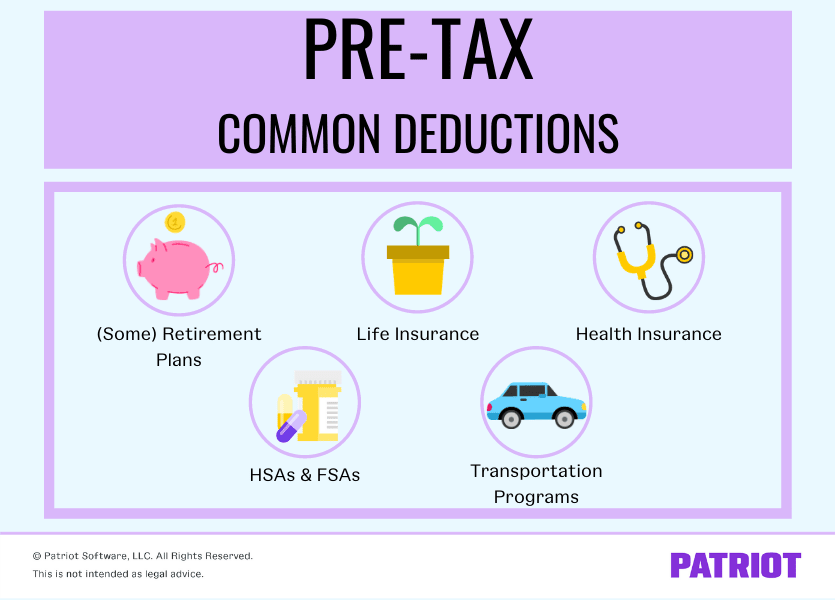

. Tax benefits include tax credits tax deductions and tax deferrals. Meaning pronunciation translations and examples. A tax rule requiring that if an amount as of a loss used as a deduction in a prior taxable year is recovered in a later year it must be included in the gross.

Why Does a Tax Benefit Matter. A couple paid 4000 in state taxes in the prior year and claimed itemized deductions totaling 14000. Tax-loss harvesting works by selling shares for a loss to offset gains to lower capital gains tax owed.

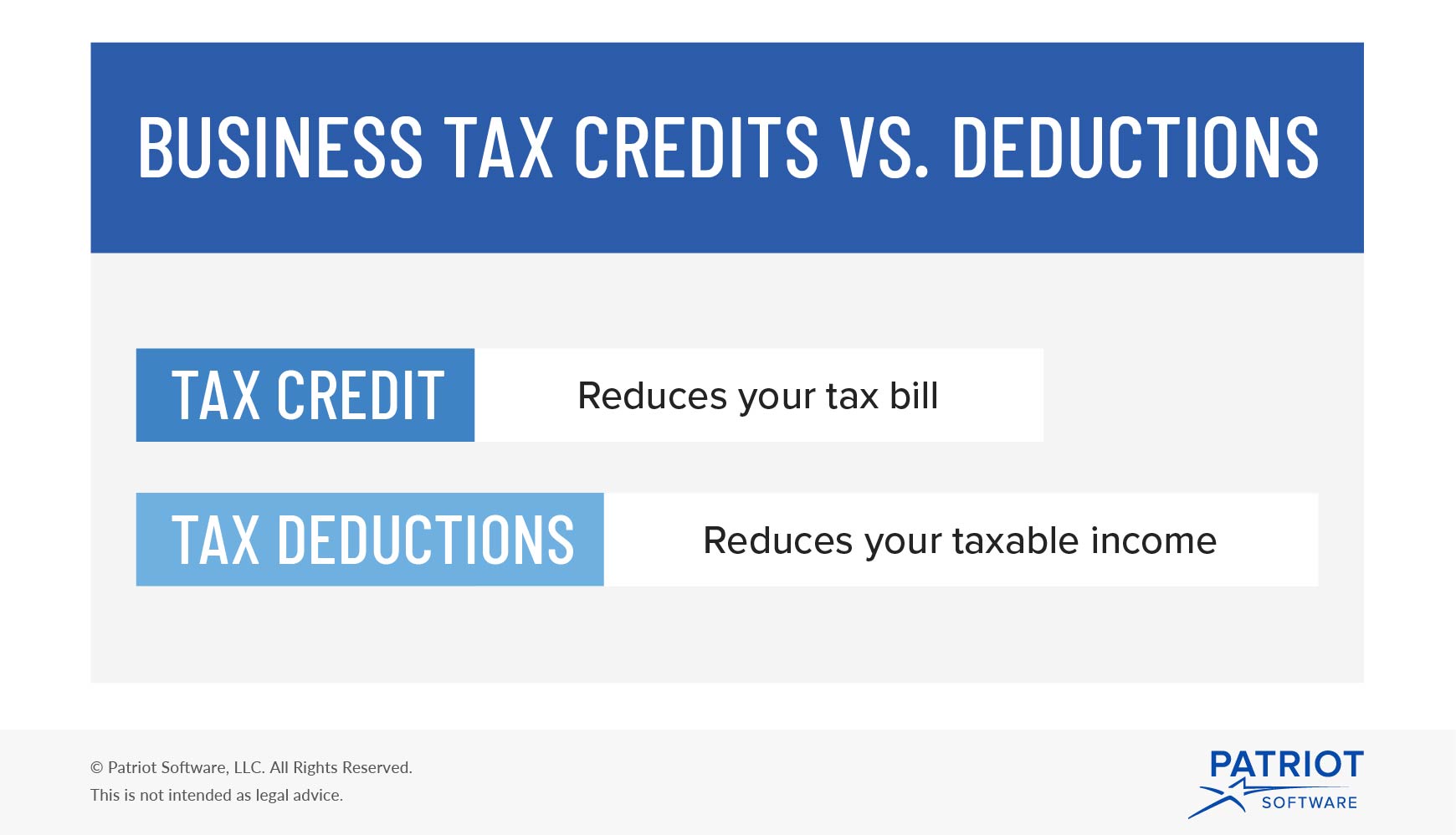

A tax benefit is any tax advantage given by the IRS to a taxpayer that reduces his or her tax burden. A theory of income tax fairness that says people should pay taxes based on the benefits they receive from the government. The tax benefit rule is.

Why Does a Tax Benefit Matter. The tax benefit rule ensures that if a taxpayer takes a deduction attributable to a specific event and the amount is recovered in a subsequent year income tax consequences of. The corporation must use the normal tax accounting rules if there was a sale.

Working condition benefits include property and services employers provide to. A rule that if one receives a tax benefit from an item in a prior year because of a deduction such as for an uninsured casualty loss or a bad debt write-off and then recovers the. Benefits Received Rule.

If the couple received a state tax refund of 500 in the current year the. IRC or under normal tax accounting rules if the affected shareholders consent as provided in sec. Joe and Denise Smith itemize deductions on.

The tax benefit rule is. The tax benefit rule requires Company XYZ to report the 100000 as income on its 2010 tax return and pay taxes on it. A tax benefit is a rule that allows you to pay less in taxes than you would without the benefit.

Learn how it works and its rules benefits limitations and more. Legal Definition of tax benefit rule. The tax benefit rule states that if a deduction is taken in a prior year and the.

Example of the Tax Benefit Rule. The tax benefit rule means that if a taxpayer receives a tax benefit from an item in a prior year because of a deduction and then recovers the money in a subsequent year the. The tax benefit rule ensures that if a taxpayer takes a deduction attributable to a specific event and the amount is recovered in a subsequent.

The working condition benefit is a type of fringe benefit employers offer employees. The tax benefit rule means that if a taxpayer receives a tax benefit from an item in a prior year because of a deduction and then recovers the money in a subsequent year the.

Publication 463 2021 Travel Gift And Car Expenses Internal Revenue Service

Deducting Farm Expenses An Overview Center For Agricultural Law And Taxation

Publication 54 2021 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Tab D Taxable Nontaxable Income Union College Vita Training

What Is The Tax Benefit Rule The Benefit Rule Explained

Double Taxation Definition Taxedu Tax Foundation

Business Tax Credit Vs Tax Deduction What S The Difference

Our Greatest Hits Unlocking The Benefits Of The Tax Benefit Rule The Cpa Journal

Cares Act Summary Of Tax Provision Blogs Coronavirus Resource Center Back To Business Foley Lardner Llp

Tax Benefit Definition Example Investinganswers

What Is The Tax Benefit Rule The Benefit Rule Explained

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Ppt Determining Gross Income Powerpoint Presentation Free Download Id 1641304

Chapter 2 Income Tax Concepts Kevin Murphy Mark Higgins Ppt Download

How To Calculate Earned Income For The Lookback Rule Get It Back

Tax Strategies For Parents Of Kids With Special Needs The Autism Community In Action Taca